Lux Research report forecasts future of solar markets

New research from Lux Research shows that the German solar market has no single heir apparent to match the rapid growth of solar in the country over the past two years, thanks to generous government subsidies. The report looks at 15 hot markets for solar that have largely been glanced over in traditional research and media, report author and Lux Research Analyst Jason Eckstein said.

New research from Lux Research shows that the German solar market has no single heir apparent to match the rapid growth of solar in the country over the past two years, thanks to generous government subsidies. The report looks at 15 hot markets for solar that have largely been glanced over in traditional research and media, report author and Lux Research Analyst Jason Eckstein said.

The report, Global Subsidy Roundup: Solar Beyond Germany, said that “the colossal German market is poised to teeter, and possibly fall, for the first time in recent memory.” The report also said that Germany’s generous feed-in tariff policy for solar market growth, which led to the installation of an estimated 8 gigawatts of solar power in 2010, accounted for roughly half of the world’s solar market.

As of Jan.1, Germany again reduced its feed-in tariff rate, which gives other countries the chance to gain bigger slices of the solar pie (not to be confused with the non-profit company Solar Pie), but that doesn’t knock Germany out of the top slot, per se.

“Germany will likely be the largest solar market in 2011,” Eckstein said. He added that China, Italy and the U.S. will likely be among the major players behind Germany this year.

Solar energy incentives like feed-in tariffs are still needed because solar costs more in almost all markets than other forms of generation, according to Eckstein.

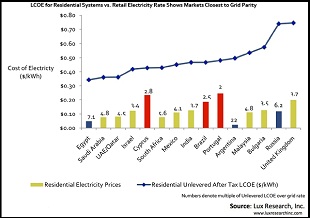

“Nobody is at grid parity,” he said. And according to Eckstein, Hawaii and parts of California are coming close. “If you look at peak pricing.”

This report was focused on potential emerging markets that manufacturers and installers may have ignored in the past, but may want to look at more earnestly.

“In general we were trying to look at things that aren’t well covered in the press,” he said.

He noted that the solar markets in the U.S. and Europe are very well covered.

“Here, we really tried to shed light on new countries that, for one reason or another, have the potential to grow a lot,” he said.

These are countries that have a combination of significant incentives or electric costs and solar resources that make solar more worthwhile. Among the potential large new markets are India, Cyprus, Brazil and Portugal, Eckstein said.

Among markets with the worst incentives and lowest opportunities for growth are Egypt, Russia and Argentina.

The reasons making a country a good place to do solar varies.

Eckstein offered India as an example of a strong, emerging market. He said that legislation enacted last year created strong subsidies for crystalline photovoltaics produced in the country.

But, oddly enough, a country like Egypt, which has plenty of sunlight, isn’t a great market for solar.

“Egypt has tremendous subsidies for oil and gas,” Eckstein said. “In markets like that, there’s almost no hope for solar.”

Image courtesy of Lux Research.