What You Should Know About Residential Solar Panel Insurance

We live in risky times, or so the mainstream media would have us believe. Unexpected windstorms, frequent bushfires caused by global climate changes, blatant thieving, and an increase in home break-ins are just some of the dangers threatening the assets housed in your residence. This is the bad news.

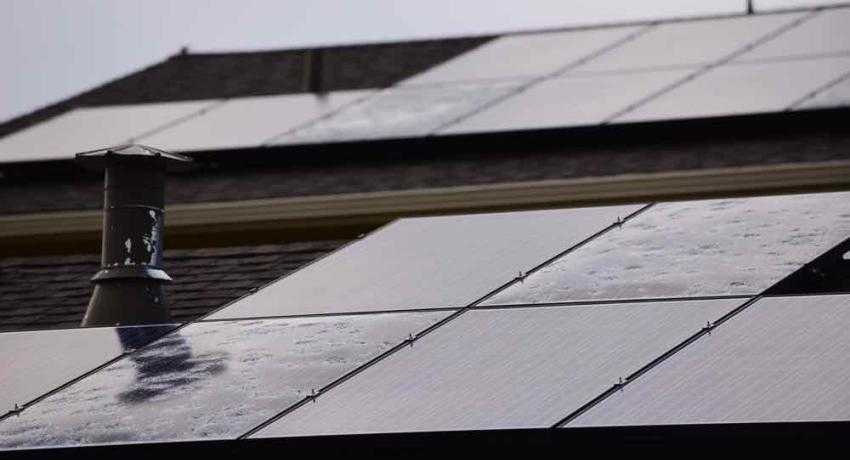

Fortunately, homeowners have an equal share of good news. Several states across the US have made persistent efforts to make solar energy more affordable to homeowners, thus causing dramatic reductions in solar installation costs. As a result, an increasing number of property owners are choosing to go the solar route to power their residences.

So, the big question is this: is your residential solar installation covered by your home insurance?

There is more positive news in this area, as solar panel insurance is indeed a possibility. However, here are some factors that will determine whether the coverage is automatic, or you will need to pay an extra premium to insure your residential solar installation.

- Type of solar installation

Solar rooftop panels are generally covered by home insurance companies. However, solar panels that are installed on the ground, or over a carport, may be excluded from coverage. Some companies may even refuse coverage altogether as they are more susceptible to damage.

- Type of coverage expected

If coverage is indeed provided by your present insurance company, then it is likely to include damage caused by the elements (like windstorms, snow, lightening, and other natural disasters), damage due to an unexpected fire breakout, and any loss incurred by theft. These are in fact reasonable measures to protect your solar setup. However, insurance companies are unlikely to cover damage caused by poor quality of installation, or even faulty solar panels.

- Type of property and ownership

If you are renting or leasing your property (and not owning it outright), insurance companies may be unwilling to include solar panels in your home insurance policy, regardless of whether you own or lease the solar setup. On the other hand, property owners can also make provisions to include leased solar panels in their home insurance policy.

Also, the type of property can be a determining factor. For instance, apartments and condos may require special clauses to cover residential solar panels.

- Credibility of contractor/solar installation

Solar installations are still considered a niche area in the US. Insurance companies will hence expect high levels of proficiency from certified contractors, before they can approve coverage for their installations. For this reason, it is advisable to ensure that your chosen contractor is certified, and approved by your insurance company, even before you begin installation. Some companies may also put a cap on the number of solar panels that can be installed, based on the size of your house.

In closing, while solar energy sometimes remains more expensive than mainstream electric energy (in many cases it’s not), the costs to install residential solar panels are at an all-time low. Add to this the various tax rebates offered by state governments, and solar energy is becoming an increasingly appealing option for homeowners.

Before you close the deal, make sure to protect your investment by ensuring that your chosen insurance company provides the best coverage for your valuable solar installation.