Solar booms in 2012, more expected in 2013 even as solar faces headwinds from fossil fuel

Solar is continuing to become a more important part of the U.S.’s energy mix as it continues to grow at a rapid pace—in fact the amount of solar added online in the U.S. in 2012 was 76 percent higher than in 2011, the previous record holder. That’s according to the GTM Research and the Solar Energy Industries Association (SEIA) annual “U.S. Solar Market Insight: Year-in-Review 2012,” which was released today (March 14). However, this was tempered somewhat by increased efforts from the fossil fuel and sometimes utility industries to tame the growth of solar, particularly distributed generation, which allows consumers to generate their own power at rates lower than what they could get from the utility.

Solar is continuing to become a more important part of the U.S.’s energy mix as it continues to grow at a rapid pace—in fact the amount of solar added online in the U.S. in 2012 was 76 percent higher than in 2011, the previous record holder. That’s according to the GTM Research and the Solar Energy Industries Association (SEIA) annual “U.S. Solar Market Insight: Year-in-Review 2012,” which was released today (March 14). However, this was tempered somewhat by increased efforts from the fossil fuel and sometimes utility industries to tame the growth of solar, particularly distributed generation, which allows consumers to generate their own power at rates lower than what they could get from the utility.

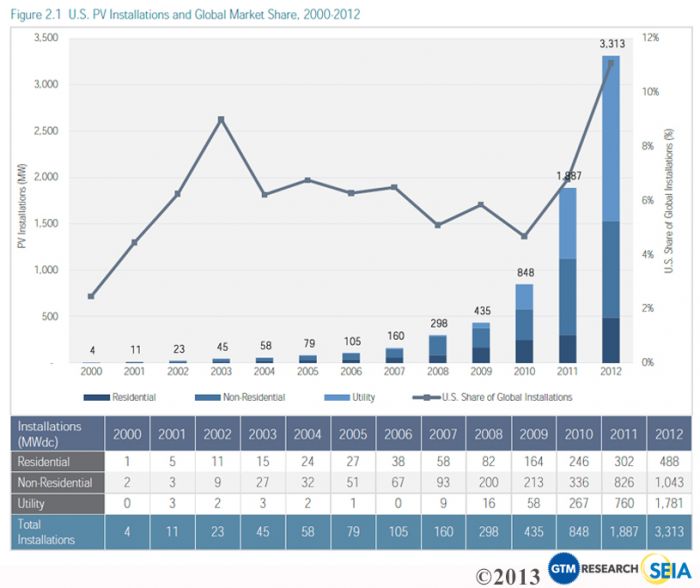

“If there was one word to describe what has happened in the past year is really ‘momentum’,” said SEIA CEO Rhone Resch during a webcast announcing the results. The annual report found that at the end of 2012, fully 7.2 gigawatts of photovoltaics and 546 megawatts of concentrating solar power (CSP) were online in the U.S. Of that more than 3.3 gigawatts of new solar was added to the grid in 2012. And the growth trend is expected to continue. The report projects that in 2013 more than 4.2 gigawatts of PV and 940 megawatts of CSP will come online in 2013 in the U.S.

Even with falling solar energy prices this represented significant market growth. “The market size of the U.S. solar industry grew 34 percent from $8.6 billion in 2011 to $11.5 billion in 2012—not counting billions of dollars in other economic benefits across states and communities,” according to SEIA.

“The solar industry has matured, and diversified in the last couple of years,” Resch said. That diversification has come across all market segments from residential-sized installations of just a few kilowatts to giant, utility-scale projects that are literally hundreds of thousands times the size or installations that are over 200 megawatts newly installed and online like the Agua Caliente project.

“There's growth in every market segement,” said GTM Research Vice President Shayle Kann. “Not every solar market globally has that. Some solar markets are entirely utility-scale or almost entirely residential. The U.S. isn't like that. We have the potential and the existence of strong markets in every market segment,” he said.

“The most dramatic growth story has been in the utility market. On a percentage basis that was the one grew the most in 2012. It's also the largest market segment in terms of megawatts installed. But I don't necessarily think that that's going to be the case forever,” Kann added. “The distributed generation market, which is residential and commercial is getting increasingly competitive across states and across markets and that's going to be a big drastic change,” he said.

As solar has become increasingly a more mainstream power source (it still makes up a fraction of the U.S.’s overall energy production), it is facing more headwinds, according to Resch. This includes utilities and entrenched energy industries pushing back against distributed generation policies like net metering. “Net-metering is one of those fundamental market access policies and when you think about the free market that exists in the US….When you have a government protected monopoly interest like a utility who is a huge impact on the policies that are developed at the state level they have the ability to strongly influence the creation of new polices or in this case settings caps on net meter,” he said. Resch contended that states need to take actions to lift net-metering caps in large solar markets like California and Massachusetts where their caps are nearly fulfilled.

Solar also is being attacked from the fossil fuel industry, Resch said. “There are a lot of challenges that are occurring to [renewable portfolio standards,” he said. For instance, The North Carolina Solar Energy Association (NCSEA) yesterday came out with a strongly worded statement against a Republican-sponsored bill that would gut the state's renewable requirements. “We're finding that most of those are occurring from frankly conservative think-tanks, like Goldwater in Arizona and the Heartland Institute. Obviously they are funded by fossil fuel interests. Some in part by the Koch brothers. And this very conservative approach is focussed on these states and introducing legislation that frankly goes completely against what the voters want,” Resch contended. In fact, studies have shown that more than 90 percent of all U.S. citizens want more solar. If such effort are successful, however, it could jeopardize the future of solar.