U.S. PV market to double in 2011, thanks to module overstock

It’s a mixed blessing.Photovoltaic (PV) manufacturer’s earnings shrunk in the second quarter of 2011 as they lowered module prices to ovoid overstock. Those lowered prices, increased utility demand, renewable portfolio standards (RPS) and the potential expiration of important federal incentives are creating a storm of demand, under which the U.S. PV market will double over last year, according to the new "United States PV Market Report" from Solarbuzz.

It’s a mixed blessing.Photovoltaic (PV) manufacturer’s earnings shrunk in the second quarter of 2011 as they lowered module prices to ovoid overstock. Those lowered prices, increased utility demand, renewable portfolio standards (RPS) and the potential expiration of important federal incentives are creating a storm of demand, under which the U.S. PV market will double over last year, according to the new "United States PV Market Report" from Solarbuzz.

This doubling over 2010 will make the U.S. the world’s third-largest solar market behind Germany and Italy this year, according to Solarbuzz. With sustained incentives and the right policies, the U.S. could grow to 12 percent of the international market by 2015.

“Under this forecast scenario, Germany would still be the largest market, but its world share will be significantly smaller than in 2010. The U.S. would grow, under the right policies and regulations, [to] the second largest market in the world by 2015,” said Solarbuzz President Craig Stevens. “The growth rates of major markets will continue to be impacted by government policies over the next 5 years, both in terms of fiscal incentives and also regulatory matters/”

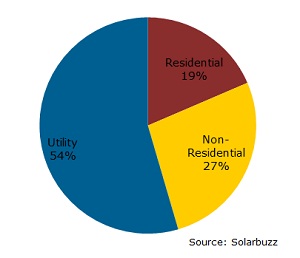

For the first time, demand for photovoltaics from the utility market in the U.S. is outpacing demand in commercial and residential markets. At the same time the pipeline of projects is growing significantly.

“Across all three segments, over 17 GW of PV projects are currently being planned,” Stevens said.

The growth this year and beyond is bolstered by renewable portfolio standards (RPS) enacted in certain states, which have utilities clamoring to add in more solar, according to Stevens.

“The utility segment is growing much faster than the residential and commercial markets. Requirements of the RPS vary by each state, and the U.S. currently doesn’t have a federal-level RPS. Some state-level RPS policies include specific solar targets,” he said.

One important mechanism that’s increased the growth of PV in the U.S., even in the face of continued economic uncertainty, is the U.S. Treasury Grant, which allows quicker access for investors to the Investment Tax Credit that they would otherwise have had to wait to receive. But it is set to expire at the end of 2011.

“The extension of the cash grant represents a market uncertainty this year, just as it did last year,” Stevens said. “Clearly, market growth will be negatively impacted next year if the cash grants are not extended at the end of 2011.”

While the news is likely good for the solar industry, U.S.-based PV manufacturers are losing ground to their Asian counterparts.

“The report also indicates a major shift in market share for module manufacturers during 2010, with China-headquartered manufacturers growing their share from 11 percent in 2009 to 37 percent in 2010,” according a press release.

PV companies in Taiwan and China will continue to grow because of lower costs, according to Stevens.

“The US manufacturing market share will continue to decline over the short term,” he said. “Although, there is still new investment in module assembly plants by many solar companies.”

Image courtesy of SolarBuzz.