Silevo tops CA’s list of PV manufacturers following commercial debut

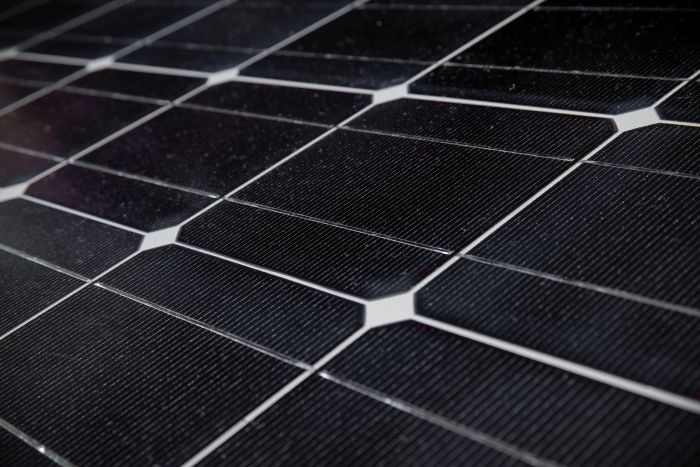

Today (Dec. 5) Silevo, a maker of next generation silicon photovoltaics, announced that it has topped California Energy Commission’s (CEC’s) module rankings for layered silicon PV modules—not bad for a company that just came out of stealth mode last year. The company achieved the results with cells that are 22 percent efficient and have withstood the equivalent of extended torture testing for PV modules.

Today (Dec. 5) Silevo, a maker of next generation silicon photovoltaics, announced that it has topped California Energy Commission’s (CEC’s) module rankings for layered silicon PV modules—not bad for a company that just came out of stealth mode last year. The company achieved the results with cells that are 22 percent efficient and have withstood the equivalent of extended torture testing for PV modules.

“It was the first product that we had certified by them and it achieved out of the gate.

There’s 12,00 modules on that listing,” said Silevo Vice President of Business Development Chris Beitel. Silevo’s technology uses a proprietary tunneling junction cell architecture that is already achieving 22.1 percent cell conversion efficiency, putting it close to the 24 percent efficient cells made by SunPower. It’s Triex modules ranked first at 93.49 percent because of their performance in tests. Largely, “Because our product performs very well in high heat,” he said.

The company has really put their modules to higher testing standards than its competitors, according to Beitel. To achieve ranking with the Go Solar initiative, PV manufacturers must verify their modules’ performance under PV-USA Test Conditions (PTC) and under Standard Test Conditions (STC) quality tests. The modules also performed very well in extended long-term degradation testing.

Most modules are subjected to Potential Induced Degradation (PID) and extended Damp Heat (DH) testing they’re tested for between 100 and 200 hours. These are high heat, voltage and moisture tests that gives insight into the quality of modules. To achieve PID compliance their performance must not vary by more than 5 percent. For the PID test, “They measured our panels through 1,500 hours,” Beteil said. For the DH testing they were tested for 2,000 hours. “We told our agency to test them until we saw failure,” he said.

The California-based company unstealthed or came out of research and development mode last year. Now it’s producing modules in China. But as it builds out its commercial manufacturing it plans to build manufacturing plants near where its demand is greatest, according to Beitel. “We plan to expand capacity upwards of 200 megawatts by the end of next year,” he said. That would put its worldwide production up to 230 megawatts of modules annually. He explained that the company’s thought process is similar to SunPower’s to manufacture in the end-market where the modules are sold. The company is looking to build manufacturing in the U.S. and Eastern Europe.

At this point the company is looking for investors to help support that expansion. Beitel contended that the company’s risk is lower than some other start ups because it uses conventional technology and the performance and testing validation helps lower the risk profile.

The company has already shipped modules to projects in the U.S., Europe and China, according to Beitel. However, he could not discuss any of the projects at this time.