New report shows U.S. major exporter of solar in 2009

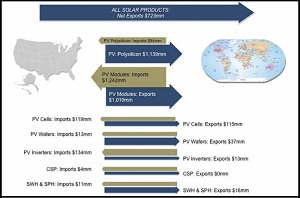

The Solar Energy Industries Association (SEIA) and GTM Research today reported that U.S. solar industry exports exceeded, by $723 million, solar imports in 2009 in their first-ever “U.S. Solar Energy Trade Assessment 2010.”

The Solar Energy Industries Association (SEIA) and GTM Research today reported that U.S. solar industry exports exceeded, by $723 million, solar imports in 2009 in their first-ever “U.S. Solar Energy Trade Assessment 2010.”

The report showed that U.S. solar market is an overall net exporter of solar technology and that the market expanded in 2010 and is likely to expand into 2011 and beyond.

“The industry is creating significant wealth in the United States and jobs in all 50 states,” said Rhone Resch, president and CEO of SEIA, during a press conference. “We’re pleased that the solar industry is helping to reduce the U.S. trade deficit through significant exports of solar energy products.”

The report is an annual, comprehensive report that shows the complex dynamics of international trade in the solar industry.

“This trade report is a first of its kind; it shows that the U.S. is a net exporter of solar. And it shows clearly that solar is driving economic growth in the U.S.,” said Tom Kimbis, director of policy & research at SEIA. He added that the U.S. solar industry created three times the value invested in the solar industry in 2009.

The report looked into all the elements of a project, according to Shayle Kann, managing director of solar research at GTM Research. “Part of the value of a solar project includes labor, site prep, all those things,” he said.

The report found, “A significant portion of the revenue generated by solar projects resides beyond the physical components—as site preparation, installation labor, permitting, financing and other soft costs comprise nearly 50 percent of the total cost.”

Overall, the solar industry created a combined $3.6 billion in direct value, of which 74 percent, or $2.6 billion, accrued in the United States. Of that, 81 percent, or $2.1 billion, was directly related to photovoltaics (PV); 16 percent, or $431 million, came from the solar heating and cooling market; and 3 percent, or $76 million, was related to the concentrated solar power market.

A big portion of the value comes from the U.S.’s export of polysilicon.

“The U.S. produced 40 percent of all polysilicon produced internationally in 2009,” explained Kann.

However, the U.S. imported more PV modules than it exported in 2009. Kann said that’s because the U.S. isn’t the leading producer of wafering. It’s behind Germany, Japan and China.

“We do have manufacturing here, but they’re the leaders,” he said, adding that the U.S.’s main PV imports came from China and Mexico.

Resch said that the U.S. is still a major exporter of PV and cited First Solar, Inc.’s global shipments as an example.

While concentrated solar power technologies, like solar troughs and towers, weren’t a large player in 2009—there were only two such domestic installations—that will change in the future, explained Kimbis. He said recent approvals by the Bureau of Land Management are allowing the domestic development of significant concentrating solar power plants in 2010 and beyond.

Still, the solar industry could be impacted by incentives, both the manufacturing side and the installation side.

“We’re concerned that there is a lack of stable, long-term federal policies in the U.S. amidst an increasingly competitive global marketplace,” Resch said at the press conference. “Even modest federal policies like expanding the 48c manufacturing tax credit can help the U.S. solar industry remain one of the few sectors of our economy that is a net exporter, while creating tens of thousands of jobs.”