Solar VC funding fell to lowest level since 2008, finds new Mercom report

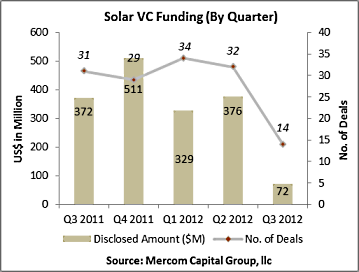

A new report from Mercom Capital Group, llc, found that solar venture capital (VC) funding fell to $72 million in the third-quarter of 2012. And at 14 deals in the quarter, that’s the lowest level since 2008, the report found. That’s also down quarter over quarter from $376 million in 32 deals in the second quarter.

A new report from Mercom Capital Group, llc, found that solar venture capital (VC) funding fell to $72 million in the third-quarter of 2012. And at 14 deals in the quarter, that’s the lowest level since 2008, the report found. That’s also down quarter over quarter from $376 million in 32 deals in the second quarter.

Raj Prabhu, managing partner at Mercom Capital Group, can’t say that it’s a trend. But, “General market conditions are not looking that great,” he said. “This could continue on.”

In the past, a lot of VC funding had supported new technologies and more efficient technologies. That may now be changing. This past quarter, downstream solar players, like installers received more funding. “This would mean, yes, the innovation or innovative products coming out will tend to be less,” Prabhu said. “[Investors are] attracted there because panel prices have gone down so much so fast, so downstream is looked at lucrative.”

Prabhu and the report found that the competition from and oversupply in the industry has led to dramatically lowered prices. “In 2009 panels prices were at $3 a watt, now they’re down to 70 or 60 cents a watt,” he said. “It really put pressure on thin-film, CSP and CPV companies.” He contended that such manufacturers weren’t able to drop their prices as quickly as silicon PV manufacturers were. That’s despite more than $1 billion in VC funding that was invested in thin film companies since 2010. While these deals may have made sense in years past, the quick and steep fall in of c-Si prices have put crushing pressure on thin film companies especially, along with CSP and CPV technologies.

The impact of smaller VC investment are being felt by all solar manufacturers. The lowered investments may impact innovations in the market. But Prabhu cautions that the two are not directly related. He anticipated that it may slow down some innovations or efficiency gains in the market, but they will largely be driven by competition as opposed to new investments.

While solar companies are maturing, particularly in the silicon sector, Prabhu thinks there’s still opportunities for companies to introduce a breakthrough technology like CIGS, he said.