Solar thrives in third quarter of 2012

This year has been a real gangbuster for solar installations in the U.S., and the trend is not likely to slow down in 2013. That’s according to the latest U.S. Solar Market Insight: Third Quarter 2012, a report by GTM Research and the Solar Energy Industries Association, which was released yesterday (Dec. 11).

This year has been a real gangbuster for solar installations in the U.S., and the trend is not likely to slow down in 2013. That’s according to the latest U.S. Solar Market Insight: Third Quarter 2012, a report by GTM Research and the Solar Energy Industries Association, which was released yesterday (Dec. 11).

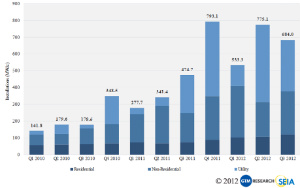

The report found that by the end of the third quarter of 2012 1,992 megawatts (MWs) of photovoltaics came online in the U.S. That’s already more than the 1,885 MWs installed in all of 2011. And more is projected to come online in the fourth quarter, said SEIA President Rhone Resch.

“SEIA expects that 2012 annual growth will top 70 percent over 2011,” Resch said. That would result in roughly 3.2 gigawatts of newly installed solar in 2012. “And we expect 2013 to be even better.” More giant solar projects, including concentrating solar projects will start coming online or reach completion in 2013.

The news puts SEIA’s goal of 10 new gigawatts of solar installed per year by 2015 within reach. “Right now we're tracking slightly below that goal but we believe it's achievable if smart policies are in place at the federal and state level.”

On a quarterly basis, it was the second best quarter for solar in the U.S.—ever. “The U.S. market saw 684 MWs of new capacity in the third quarter of 2012. This is up 44 percent from the same quarter last year,” said GTM Research Solar Analyst Andrew Krulewitz. However, he observed that the quarter was second only to the second quarter of 2012, when 775 MWs of solar came online.

While some of the growth was seen through portions of giant PV arrays like Agua Caliente and California Valley Solar Ranch coming online, The quarter also saw significant growth in the residential sector, according to Krulewitz. “Residential had the biggest quarter every with more than 118 MWs of new solar installed. This represents a 12 percent growth quarter over quarter and 62 percent growth year over year,” he said.

States that led the residential growth in the quarter included California, Arizona, New Jersey and Massachusetts. California alone installed 50 MWs of residential solar, while growth in the Massachusetts non-utility markets grew the most, by 60 percent on a quarter over quarter basis.

Much of the growth to third-party is attributable to third-party ownership companies, which now offer services in 22 states. “The installation prices and costs for these third-party ownership model companies continue to fall in line with direct consumer installations,” Krulewitz said. “In some cases such as in the case of California, they're being reported at even lower prices than direct to consumer installations,” he said.

“The reason for this being is that a lot of these companies have now achieved a certain size and significance, regarding installations that they're able to streamline their processes and have a larger purchasing power. Overall we expect continued growth in the residential market segment especially in California and Arizona,” Krulewitz said. “It's interesting to note that in these states the rebates are nearly gone for residential systems. The high avoided costs for the significant levels of solar installation insure energy savings to homeowners just utilizing the 33 percent Investment Tax Credit.” That’s because the cost of installed solar has dipped so much as modules become cheaper, companies get better at installing solar and there are better state policies around solar.