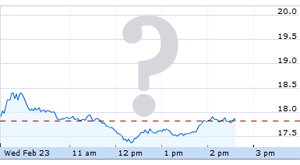

Solar stocks up on earnings statements, but still volatile

As solar companies have released their fourth quarter earnings, solar stocks have shot up, tempered only by worries about diminishing subsidies for the industry.

As solar companies have released their fourth quarter earnings, solar stocks have shot up, tempered only by worries about diminishing subsidies for the industry.

Some companies saw their stocks run up this month because of stronger-than-expected fourth-quarter earnings and lifted outlooks for 2011, said Adam Krop, a senior analyst with Ardour Capital Investments. Among those companies were SunPower, Trina Solar and Yingli Solar.

Much of that increase can be credited to reports that increased outlooks for 2011.

Those reports helped ease fears that 2011 industry volume would be flat from 2010, which was a banner year.

"We think a growing number of investors out there are starting to be more comfortable with 2011 growth projections," Krop said.

These stocks saw extremely sharp gains in the market after their announcements, but have since slipped backward some.

"The space is extremely volatile," Krop said of solar stocks. "Yes, most of the stocks are up year-to-date, but many of the top stocks in this space are down 4 to 5 percent today. They're volatile due to their exposure to subsidy programs. Solar is a subsidized industry, and any time you hear about possible adjustments to subsidy structures, the stocks react."

One reason they may be down some this week is that Republicans in the U.S. House have the loan guarantee on the chopping block in budget negotiations, Krop said. Cuts to the loan guarantee could impact large-scale solar developments in the U.S.

While most of those projects will probably still get done because of an increase in financing appetite and healthy returns, Krop said, any threat to growth in the U.S. market tends to scare investors off because the U.S. is expected to be a big growth driver for solar in 2011.

Much of Europe has cut back its solar subsidy programs as the U.S. is just beginning to scale its up. The solar market was subdued during 2010 because of fears that Europe’s falling subsidies would dent industry volume.

"We saw the stocks run up in January because of some of the uncertainty Germany took out of the market,” Krop said, “and expectations for a strong 4Q10 reporting period."

Germany is likely to make another mid-year special reduction to its subsidy, Krop said, which assuaged fears the country would cut deeper or impose an annual cap on installations.