The fight begins for renewable energy funds in the House

With the DOE Loan Guarantee program on the Republican-led House’s chopping block, Calif. Sen. Diane Feinstein (D) issued a letter to her fellow Democratic Senators last week urging them not to allow the cut.

With the DOE Loan Guarantee program on the Republican-led House’s chopping block, Calif. Sen. Diane Feinstein (D) issued a letter to her fellow Democratic Senators last week urging them not to allow the cut.

She asserted that if the House cuts the renewable energy program could devastate companies and projects well on their way to leveraging the loan guarantee to finance projects or expansions.

Although the guarantees are not a loan, they make it easier for developers of large-scale renewable energy projects and renewable energy manufacturers to secure funding for expansion.

“There are some manufacturing companies that have manufacturing facilities in the U.S. that would not get off the ground without federal loan guarantees,” Pavel Molchanov, an analyst for Raymond James & Associates, an investment firm. “We’ve seen a number like Abound, Suneva, SoloPower. They’ve all received loan guarantees.”

Companies that would be most affected are private companies that don’t have access to funding opportunities that public companies have.

“Almost all the manufacturing companies that have received loan guarantees are private companies,” he said.

Molchanov said a repeal of the program would affect not just solar, but alternative-energy startups of all kinds. These include biofuels, grid or power storage companies, wind and more.

Sen. Feinstein acknowledged the success the program has already had in getting renewable energy startups and projects off the ground. But she focused the letter on how the House’s actions would halt the DOE from finalizing every renewable energy loan application currently under review.

“Five conditional loans already issued to renewable energy projects would have to be withdrawn, while 26 loan agreements with final-term sheets in hand could never be completed,” she wrote in the letter. “These 31 projects are seeking $15.5 billion in loans to finance $24.2 billion in new energy infrastructure, which would put more than 35,000 Americans to work.”

She added, “The firms have lined up $9 billion in equity investment from the private sector and have spent hundreds of millions of dollars to date on application fees and project development, much of which would be lost.”

GTM Research managing director Shayle Kaan said the impact would be most keenly effect developers of large-scale concentrated solar projects.

“Photovoltaics are at a point where they’re proven technology,” Kaan said.

Molchanov agreed.

“Loan guarantees are important for large-scale utility-scale solar developments,” he said. “The industry that would be more affected is solar thermal or solar concentrating. It’s almost entirely utility scale.”

Both analysts said that the effects on large-scale developments won’t be felt that much in 2011 or even 2012.

“I think the impact would be substantial on a three- to five-year period, but not in 2011,” Kaan said.

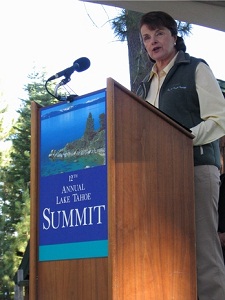

Pictured: Sen. Feinstein addressing a crowd at the 12th annual Lake Tahoe Summit, courtesy of her office.