Securitization could reduce cost of solar energy by 16%

The National Renewable Energy Laboratory (NREL) is looking at applying an old tool to solar to bring it’s levelized cost of energy (LCOE) down significantly—up to roughly 16 percent. The tool’s called securitization.

The National Renewable Energy Laboratory (NREL) is looking at applying an old tool to solar to bring it’s levelized cost of energy (LCOE) down significantly—up to roughly 16 percent. The tool’s called securitization.

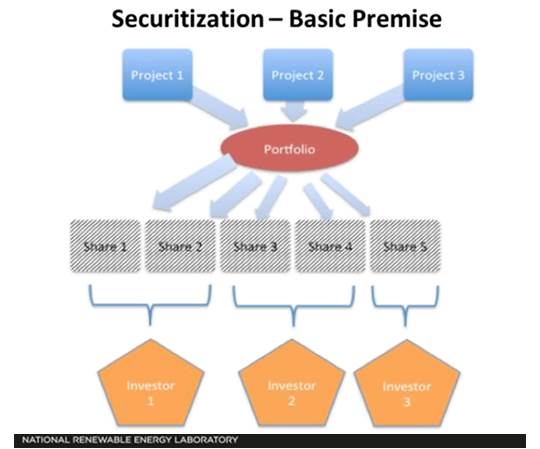

The lab recently created the Solar Access to Public Capital (SAPC) working group to make securitizing solar projects. Basically, under securitization a bunch of solar projects are put into one portfolio, bundled, then sold to investors are shares in the portfolio. By grouping the projects together it reduces the chance the that the projects won’t make the anticipated return on investment. And it also offers stable long-term returns on the investment.

Securities and similar tools like bonds, also offer often carry lower interest rates for investments as opposed to bank loans, which have higher interest rates and shorter payback times. This is where the potential 16 percent savings lie. Securities are attractive to companies and organizations looking for such long-term funds, groups like insurance companies, retirement funds, and they can also let the individual investor get in on solar at a much lower rate than they otherwise could because, after all, not everyone has Warren Buffett’s deep pockets.

Through the SAPC working group NREL is bringing together an impressive group of companies, from Bank of America to SolarCity to SunRun to Clean Power Finance to Recurrent Energy—in total more than 60 entities already—to discuss on how best to securitize the industry. “It’s exciting to see the industry come together to build the foundation to a securitized market,” says NREL Senior Financial Analyst Michael Mendelsohn. “Access to low-cost public capital offers the potential to significantly lower the cost of solar energy.”

GTM Research agrees. “Mendelsohn’s report on the early progress of U.S. Department of Energy (DOE)-funded research on opening up solar to public investment through securitization showed it could lower the levelized cost of solar energy-generated electricity by 8 percent to 16 percent for the best quality projects,” said GTM Research’s Herman Trabish.

SAPC’s primary efforts center on the standardization of power purchase agreements, leases, and other documents relevant to residential and commercial deployment, and the development of robust datasets to assess performance and credit-default risk. These activities are designed to allow projects to be grouped into tradable securities. Securitization is expected to attract additional investors to the solar asset class, enabling the industry to tap a larger and more liquid pool of capital than currently available. The working group includes over 60 members representing some of the leading organizations in the fields of solar deployment, finance, counsel, and analysis.

One of the reasons, besides the obvious reason of wanting to help the industry out is that there’s more demand for solar (and wind) than there is bank capital, and the incentives behind both, unlike for fossil-fuel based energy, are expected to subside in the coming years. At the same time, “Based on DOE-established targets, the solar and wind energy industries’ need for capital will double and approach $70 billion by 2020,” Trabish said.

The working group’s efforts are now centered on standardizing power purchase agreements, leases, and other documents relevant to residential and commercial deployment, according to NREL. It will also work on creating datasets to assess performance and credit-default risk. Between standardizing and creating the datasets, it will make it easier to bundle projects into portfolios and create the tradable securities.

GTM’s Vice President of Research Shayle Kann, among other solar analysts anticipates that the first solar asset-backed securities (SABS) will be in the solar third-party ownership business. That will mean companies like Clean Power Finance and SolarCity will create an asset-backed security out of the projects they develop on rooftops.