PV to fall to $0.37 per watt in 2017

That’s according to a new GTM Research report introduced today (June 18). The report contends that by the end of 2017, the costs of manufacturing crystalline silicon PV modules will fall to 37 cents per watt for leading Chinese PV manufacturers including Jinko Solar, Renesola, Trina Solar and Yingli Green Energy.

That’s according to a new GTM Research report introduced today (June 18). The report contends that by the end of 2017, the costs of manufacturing crystalline silicon PV modules will fall to 37 cents per watt for leading Chinese PV manufacturers including Jinko Solar, Renesola, Trina Solar and Yingli Green Energy.

The majority of the price drops will come from innovations, like diamond wire sawing of silicon wafers, metallization advances and manufacturing mechanization, according to the new report PV Technology and Cost Outlook, 2013-2017.

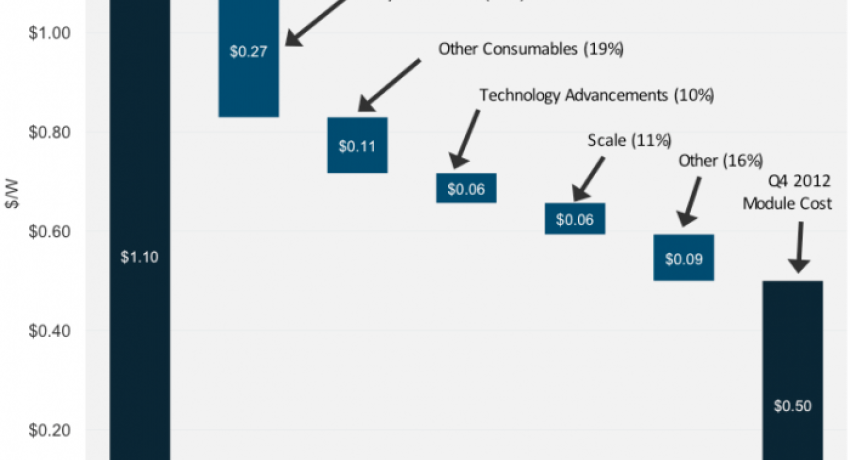

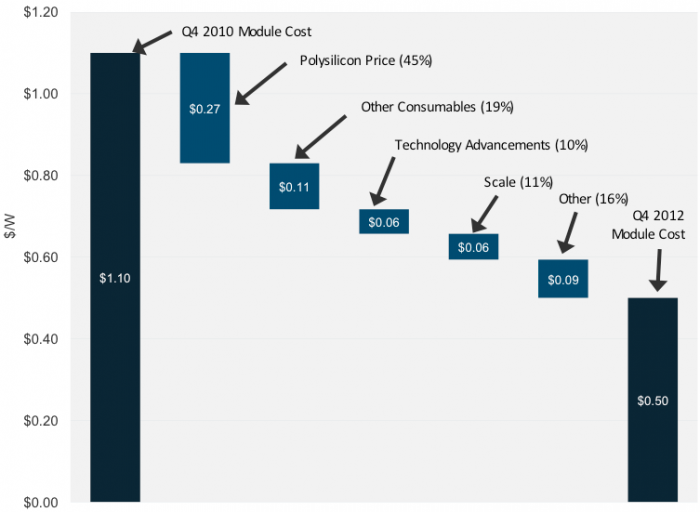

It’s the latest sign that previous predictions for the solar industry fell short in terms of falling prices. “Yesterday’s PV cost reduction roadmaps are no longer relevant today,” said report author and GTM Research Senior Analyst Shyam Mehta. “Three or four years ago, the industry was targeting one-dollar-per-watt costs in 2013; today, we are at 50 cents per watt, and there is currently little consensus on what is a realistic goal for the module supply chain to set for itself over the next three to five years. This is important not only for these manufacturers and their investors, but also for installers and project developers across the globe.”

In fact, as recently as December 2012, at least one analyst firm said that the cost of solar would drop to 48 cents per watt in 2017. In that report Lux Research said the cost reductions would come about from efficiency gains and more production in China.

“With supply consistently 200 percent of demand annually, c-Si module prices have fallen approximately 70 percent in two years,” Mehta said. “One positive externality of this cutthroat pricing is that manufacturing costs have fallen in line with pricing declines. This is mostly because pricing for key inputs further up the value chain has also fallen as a result of overcapacity and consequent margin evaporation.”

The GTM Research report observed that the industry is starting to face some changes in how it will drive price drops. “While precipitous cost declines of roughly 70 cents per watt from 2010 to 2012 were made possible by cutthroat pricing and margin erosion in the polysilicon and PV materials markets, the report sees cost reduction drivers migrating in-house for wafer, cell, and module suppliers, as adoption of advanced technology platforms and manufacturing automation will account for 80 percent of the forecasted declines,” GTM Research said.