Give solar, wind cash over tax credits and save government money!

That’s the finding of a new report from the Climate Policy Initiative “Supporting Renewables while Saving Taxpayers Money”. Basically the report looked at how current incentive schemes like the Investment Tax Credit for solar and the sunsetting Production Tax Credit for wind have been effective. But it finds that by shifting the incentives from a tax-based incentive to smaller cash-based incentives the government could support renewables while saving money.

That’s the finding of a new report from the Climate Policy Initiative “Supporting Renewables while Saving Taxpayers Money”. Basically the report looked at how current incentive schemes like the Investment Tax Credit for solar and the sunsetting Production Tax Credit for wind have been effective. But it finds that by shifting the incentives from a tax-based incentive to smaller cash-based incentives the government could support renewables while saving money.

During a Webinar discussing the report coauthor Kath Rowely said federal incentives are critical to encouraging renewable energy deployment. “They covered half the gap between the cost of renewable generation in 2010 and market prices for electricity. And we find looking forward that federal incentives could bridge nearly the whole gap for wind by next year,” she said.

That being said, the report found that a significant share of a tax credit’s value can get used in transaction cost and expensive tax equity finance, according to Rowley. “In terms of improvement we find that cash incentives could do the same job as current tax incentives at about half the cost to governments,” she said.

Speaking during the Webinar, report coauthor Uday Varadarajan explained that tax credits are most useful to companies with significant and predictable tax liabilities that they can offset and not for governments. “But otherwise if they [i.e., developers] don’t have that, they’ll have to bring in a tax equity investor or take in the tax equity over time. Either way about a third of the credit’s value gets used up in that transaction cost,” he said. It also adds a premium for tax equity if they do it that way.

“Essentially governments can save money by moving to smaller taxable cash incentives. Cash incentives are more efficient than tax credits because they enable lower-cost financing. You don’t have to go through tax-equity financing and you can often get more debt,” Varadarajan said. He added that taxable cash incentive are even more efficient for helping make solar and wind more renewable. “The point here is that they actually help developers make better use of other tax benefits like depreciation.”

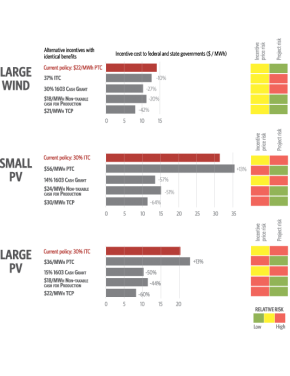

Ultimately the report recommended that policymakers enact different types of incentives for renewables. First off it recommended extending the production tax credit of $22 per megawatt hour for wind but instead as a $21 per megawatt hour taxable cash incentive for energy production. The report said it would reduce the cost of the incentive to federal and state government by around 40 percent for every unit of clean electricity generated. It also recommended allowing solar PV projects the option to take a 20 percent 1603 Cash Grant in lieu of a 30 percent investment tax credit, which would similarly help lower the impact on the government of support renewable projects while lowering financing costs for solar.