Following final ruling on PV tariffs Chinese imports to US drop

One of the hottest, most contentious issues in the U.S. solar industry in 2012 was the impact of China artificially lowering prices of its photovoltaics in an attempt to undercut competition from manufacturers in the U.S. and around the world.

One of the hottest, most contentious issues in the U.S. solar industry in 2012 was the impact of China artificially lowering prices of its photovoltaics in an attempt to undercut competition from manufacturers in the U.S. and around the world.

The pricing practices jeopardized manufacturers in the U.S. and around the world because they didn’t benefit from the heavy subsidization that Chinese PV manufacturers enjoyed from their federal government, hence they weren’t able to drop prices as quickly or as drastically to keep up. Now the tariffs, imposed by the Securities and Exchange Commission and the International Trade Commission have come into effect and, according to the Coalition for American Solar Manufacturing (CASM), the number of photovoltaics imported from China has declined significantly.

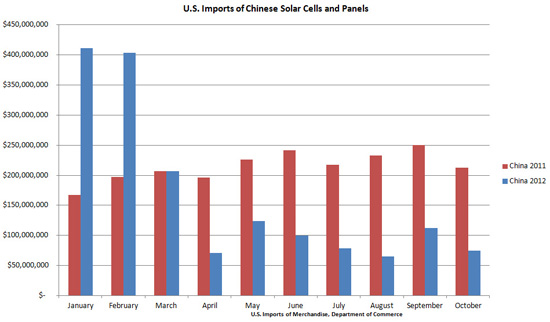

CASM reported that imports of crystalline silicon PV cells and modules from China fell significantly in October 2012. “Total Chinese imports valued at $75 million in October, down from $112.7 million in September, represented a decline of about two-thirds from $213 million in October 2011, according to the U.S. Census Bureau’s U.S. Imports of Merchandise database,” CASM said. The declines were just latest in declines of imports from China since the preliminary tariffs—ranging from 24 percent to more than 250 percent—were imposed earlier this year on a preliminary basis. The decline in imports from China reflects the market’s recognition of the anti-dumping and anti-subsidy duties, CASM said.

CASM, a coalition chiefly backed by SolarWorld and a coalition of 228 U.S. employers of about 18,000 workers working in the solar industry, lodged the original complaint agains the Chinese PV manufacturers in 2011. In their initial complaint SolarWorld and CASM contended that China’s subsidization forced roughly 25 U.S. PV-makers producers to shutter or downsize their operations.

The complaint actually caused a rift in the solar industry between PV manufacturers, equipment manufacturers and installers. A larger coalition, the Coalition for Affordable Solar Energy (CASE), fought against CASM’s claims, asserting that the tariffs would be bad for U.S. companies and might not have the intended effect. CASE included solar installers and developers who welcomed the lower prices, since they were able to quickly reduce the cost of the PV they were installing across the U.S. It also included solar equipment manufacturers, who benefited from equipment orders from China.

Despite the tariffs prices have remained low even after the tariffs were imposed. There are a number of reasons for lack of price change, which include continual oversupply as more manufacturers have entered the PV market and manufacturing shifting. As Chinese manufacturers anticipated the tariffs, they had time to change their manufacturing processes in a way that allowed them to avoid, in many circumstances, paying such tariffs. Still, according to CASM, the U.S. Department of Commerce could revisit the issue next year if it determines that Chinese pricing fell more than equivalent market-economy production costs for those imports in 2012.