Ascent Solar inks deal worth up to $450 million to increase Asian presence

Colorado-based Ascent Solar Technologies, Inc. (NASDAQ: ASTI) announced on August 15 that it reached a strategic partnership under which China-based TFG Radiant Group invested roughly $450 million plus royalties to Ascent. The investment includes TFG Radiant’s licensing of Ascent’s flexible thin-film CIGS (copper, indium, gallium, diselenide) photovoltaic technologies, as well as TFG Radiant’s agreement to build a 100-megawatt annual capacity production plant in East Asia.

Colorado-based Ascent Solar Technologies, Inc. (NASDAQ: ASTI) announced on August 15 that it reached a strategic partnership under which China-based TFG Radiant Group invested roughly $450 million plus royalties to Ascent. The investment includes TFG Radiant’s licensing of Ascent’s flexible thin-film CIGS (copper, indium, gallium, diselenide) photovoltaic technologies, as well as TFG Radiant’s agreement to build a 100-megawatt annual capacity production plant in East Asia.

Under the partnership, Ascent Solar will have an ownership stake in Asian fabrication plants and receive royalties.

TFG Radiant Group is a joint venture of Radiant Group and Tertius Financial Group. Radiant is a Chinese construction and real estate company, and TFG is a private investment firm based in Singapore, according to a press release.

TFG Radiant will invest $275 million and pay royalties and will invest $165 million to develop the company’s first Asian fabrication plant. In exchange TFG Radiant can opt to appoint a member to Ascent's board of directors. If it increases its investment in Ascent in the future, it could appoint a second member, according to a press release.

With the investment, TFG Radiant has a 20 percent stake in Ascent, according to Kelly Brandner, a spokesperson for Ascent. That’s before TFG’s exercised all of its options.

“It’ll be 35 percent with all options,” she said.

Ascent saw the investment as an opportunity.

“This is their way of tapping into the Asian market,” Brandner said.

Particularly in the building-integrated photovoltaic market. By using the licensing model and developing the fabrication plant with TFG Radiant, the company didn’t have to raise significant capital as part of its expansion into the market, she said.

There’s an additional bonus to the deal.

“[Radiant is] a leading roofer in China, so they already have the market base. Ascent sees it as a way to tap into the BIPV market,” Brandner said.

The move follows Ascent’s announcement that it was moving away from the BIPV, or building integrated photovoltaics, market in the U.S. because the economic meltdown has slowed growth of new buildings, a key target for BIPV systems.

“In Asia, it’s much cheaper to put BIPV in new construction,” Brandner said.

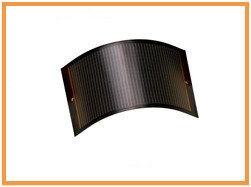

Image courtesy of Ascent Solar.